Overview

JP Morgan Chase is a multinational banking and financial services holding company. It is the largest bank in the US and has $2.4 trillion in assets. JPM operates in four main businesses:

-

Consumer & Community Banking

Deposits, credit card issuance. Target annual net income $1800m - Corporate & Investment Bank

Fixed income market revenue, equity, long-term debt, loan syndications, m&a. Target annual net income $1025m - Commercial Banking

Deposits and loans for business. Target annual net income $450m - Asset Management

Mutual funds, money market funds, and global private banking. Target annual net income $800m

Is its enormous size an impediment to growth for JPM? Not according to Jamie Dimon (Chairman and CEO), in his most recent letter to shareholders. He says that the scale and breadth create large cross-selling opportunities and give competitive advantage–for example, the private banks gets new clients from the Investment and Commercial banks, and the Investment bank generates 29% of its revenue from its Commercial bank local clients.

Perhaps this is also why JPM has outperformed its peers in the Global Banks sector over 3-year (10.05% vs 5.32%), 5-year (10.95 vs 7.29), 10-year (6.09 vs -5.26), and 15-year (1.95 vs -1.77) periods. All figures from Morningstar. It has underperformed the S&P over each of those timeframes, but that is another story.

Performance

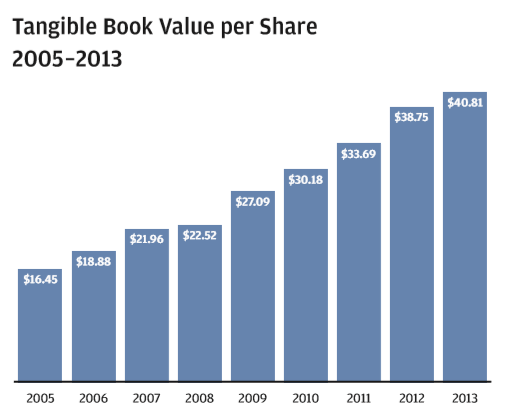

Below is a bar chart that shows how JPM has managed to build its book value per share since 2005. It shows an increase every year, including through the Great Chaos (the Bear Stearns and Washington Mutual acquisitions?)

Tangible book value per share is a useful valuation tool for banks and this was highlighted by Jamie Dimon to explain why JPM was buying back its own stock in 2011:

Our tangible book value per share is a good, very conservative measure of shareholder value. If your assets and liabilities are properly valued, if your accounting is appropriately conservative, if you have real earnings without taking excessive risk and if you have strong franchises with defensible margins, tangible book value should be a very conservative measure of value.

Note: Tangible book value per share is defined by Investopedia as follows:

A company’s tangible book value looks at what common shareholders [Ed: no offence intended] can expect to receive if the firm goes bankrupt and all of its assets are liquidated at their book values. Intangible assets, such as goodwill, are removed from this calculation because they cannot be sold during liquidation. Companies with high tangible book value per share provide shareholders with more insurance in case of bankruptcy.

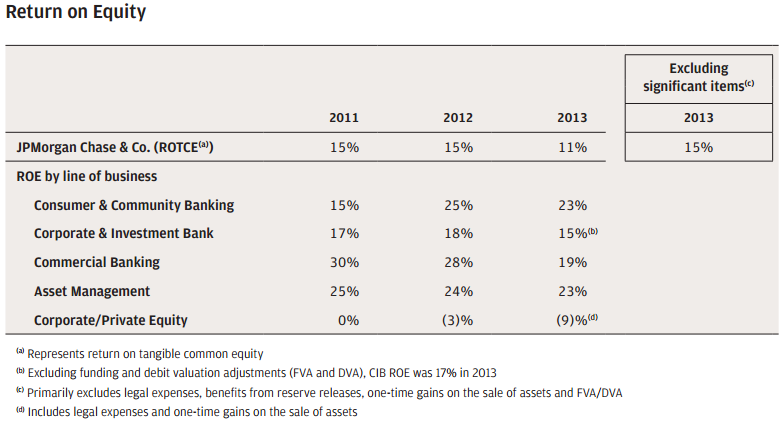

JP Morgan’s Return on Equity, excluding significant items such as one-time legal expenses and asset sales, for 2013 was 15%. Here is the relevant table from the annual letter:

Jamie Dimon has said that he hopes to continue returning 15% ROE over time. s currently gloomy disposition towards banks improves.

One other benefit of JPM’s diversification, as stated by Dimon in his 2013 letter to shareholders, is that if higher capital requirements drag on its RoE, then it can exit unprofitable areas and emphasise better areas—for example, many exotic derivatives and subprime mortgages will no longer be offered. Other products will be repriced or redesigned to rebuild margins.

Capital

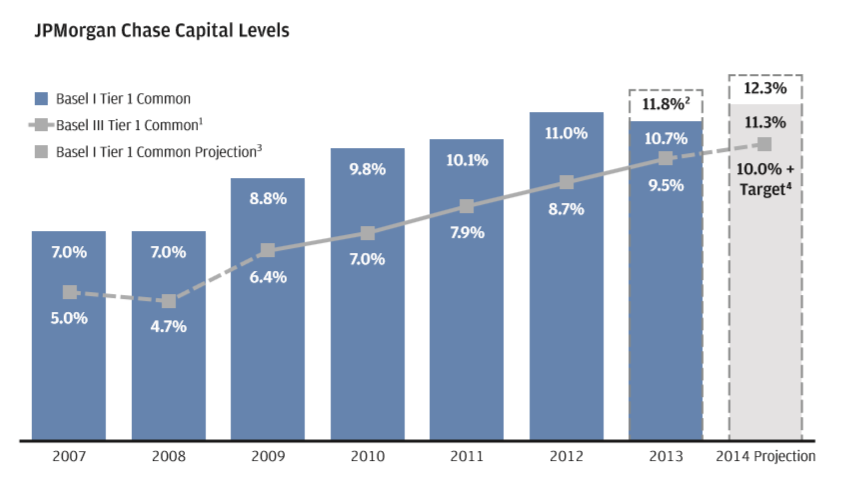

In 2014 JP Morgan will meet all of its current captial, liquidity, and leaverage ratio targets. Under Basel I, for example, the Tier 1 Common has gone from 7.0% in 2007 to 10.7% in 2013. The bank is now much better capitalised than it was going into the crisis, which it survived. Any drag on profitability that results from more capital (and JD thinks that this can be overcome) is more than compensated for by better nights’ sleep for its shareholders. Here is the chart:

Another interesting point made by Dimon is that the new (tougher) banking regulations might actually create a wider moat around their business by making life more difficult for new competiors. This reminds me of tobacco regulation which, due to the ban on advertising, makes it impossible for new tobacco manufacturers to break into the market thereby creating what is virtually a regulated oligopoly for the existing manufacturers. The law of unintended consequences might strike again.

Valuation

I am going to use three techniques to look at this:

-

Intrinsic value (Ben Graham formula)

- Pretax earnings multiple

- Price to TBVPS

Intrinsic value

Firstly, Ben Graham’s modified intrinsic value formula (see here for the equation).

Where:

EPS = Earning Per Share, (trailing twelve months EPS is $4.03)

2g = Twice the expected annual growth rate (I use Morningstar’s analyst consensus -15%, 7.6%).

y = The current yield on 10-yr AAA corporate bonds (2.91).

8.5 = Graham’s multiple for a no-growth company.

4.4 = The average yield of high-grade corporate bonds in 1962, when this model was introduced.

JP Morgan Value: $144.42

JP Morgan Current Price: $53.83

RGV (Value/Price): 2.68

Verdict: JP Morgan is clearly very undervalued and contains a big margin of safety.

Pretax earnings multiple

Secondly, the pre-tax earnings multiple Buffett likes to pay for a business is 10x. Here is what Buffett and Munger said on the subject at the 2012 Berkshire shareholders’ meeting:

Buffett: We would love to buy operating businesses priced at 9x to 10x pretax earnings. We would consider higher mutliples of earnings if we knew the company well. EBITDA is nonsense.

Munger: I don’t even like to hear the word “EBITDA”.

Buffett: It’s basically “EBE”: Earnings before everything.

Source: Gongol notes from the 2012 Berkshire Hathaway shareholders’ meeting, via warrenbuffettonivestment.com.

Brooklyn Investor has done some brilliant work reverse engineering many of Berkshire’s biggest investments to check whether this measure was applied to the purchases, and it was. See his fascinating post on the subject here. So what are the latest earnings figures for JP Morgan? I use the same technique as was used by BI in one of his posts, which is to sum the net income to shareholders and the provision for taxes for the last twelve months.

Net income to common shareholders Provision for taxes Pretax income

2Q 13 6,101 2,802 8,903

3Q 13 -650 414 -236

4Q 13 4,937 2,222 7,159

1Q 14 4,898 2,233 7,131

(all figures in USD$m and from Morningstar)

So, by totting up the pretax income figures we can see that the total for the last twelve months is a mighty 22,957. Dividing this by the number of shares outstanding, 3.8bn, gives us pretax earnings per share of $6.04. And so, assuming my sums are correct and the latest share price of $53.83, we can currently buy JP Morgan for just under 9x pretax income. It would be possible to pay anything up to $60, using this technique. Bearing in mind the fact that these earnings figures include some huge one-time legal fees, in reality, we could probably pay quite a bit more.

Price to tangible book value per share

So, given what Dimon has said about tangible book value per share being a good and very conservative measure of shareholder value, what has this done in recent years and where is it now?

As can be seen from the graphic in the Performance section above, tangible book value per share for 2013 was $40.81m. Compounded annual growth to tangible book per share for the period shown was 12.03%, despite the small matter of the financial crisis wreaking merry havoc in the middle.

With the price currently at $53.83, you can’t unfortunately buy into JPM at tangible book any longer. But the multiple is still at a very tempting 1.3x, or actually a bit lower if you assume that tangible book value has grown over the first five months of this year. That must leave plenty of room for a re-rating higher, given that JP Morgan is expected to earn 15% return on tangible equity for the foreseeable future (1.5x should be justifiable). In addition, there is of course the potential for continuing growth in book value, absent another crisis, as interest rates rise and the US housing market and economy continues to normalise.

Yes, financials are volatile and risky. But JP Morgan has come through the test and, to my eyes at least, the price now offers a very comfortable margin of safety. I think JPM would (will) add some very worthwhile diversification to my portfolio.

Disclosure: I do not currently own shares in JPM.

Disclaimer: This post is not a recommendation to either buy or sell. Please consult your investment advisor.