There was much popping of corks and clinking of glasses in the City last week when the FTSE–finally–managed to surpass its previous closing peak of 6930, which was remarkably set on the last of 1999. Peaks being surpassed and earnings records being beaten should of course be something that happens with smooth regularity as economies advance but, in this case, it was a painfully drawn-out process indeed.

Partly this is because the previous peak saw valuations become so absurdly stretched that it took a decade for earnings to catch up, but it was also because of the numerous body-blows the poor old FTSE has had to take in the last 15 years: not least the decimation of the banking sector, followed recently by the retail and oil sectors. Nevertheless, here we are, with the FTSE finally looking at clear blue sky above (or standing on a trap-door, depending on your disposition).

Grist to their Mill

This fifteen-years-to-get-your-money back argument is one commonly deployed by stock-market sceptics when they disdain the stock-market as a playground suitable only for spivs, sharks and guttersnipes. Fortunately for investors, however, the argument doesn’t ring entirely true. If dividends are included in the FTSE’s returns, then £10,000 invested in the FTSE 100 on 30 December 1999 would have turned into more than £15,000 today (see this article for full details). Ok, that isn’t going to mint many new millionaires, but it has helped savers to keep ahead of inflation (which is my main goal) and it is certainly better than the pancake flat return implied by the bald, headline market number. Bonds, incidentally, would have done better turning £10,000–shockingly–into around £24,000, but that is another story.

Don’t mention the dividends

So why, given how important dividends are to total return, does the headline FTSE figure not include dividends, i.e. quote its total return? No shareholders of any of the FTSE 100’s stalwarts like HSBC, Glaxo, British American Tobacco, or Unilever are unaware of the importance of those pleasantly predictable cheques that drop on the doormat twice or four times a year, so why does the index not make things clearer to new investors by including them too? Sometimes I think that dividends are a guilty little secret known only to the initiated; that ability to get paid for doing nothing more than “sitting on your ass”, as Charlie Munger would put it, while your companies push out loans, invent vaccines, sell cigarettes, ice-cream, software or whatever else it happens to be.

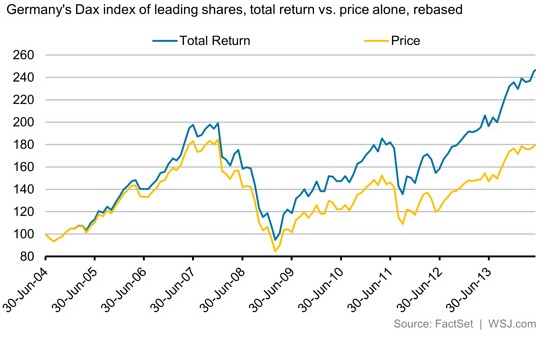

But why keep it secret? Buying shares in some of our country’s (and the world’s) biggest and best enterprises gives people a real stake in things, and more people would surely do it if they understood the concept of total return. Germany’s DAX is quoted in terms of total return, something I only found out recently having long been intrigued by its apparent outperformance of our own FTSE. If you are doubtful as to the impact of dividends on the Dax’s record, then have a look at this chart which shows the difference between the DAX with dividends (blue, and the version we see quoted) and a price-only version (yellow):

Dividends matter and should not be kept secret!

PS: See this excellent post by James Mackintosh for more detail on this subject.