The Voya Corporate Leaders Trust Fund was founded on one simple piece of logic – companies that prospered in the Great Depression could prosper in all economic and market conditions. The Trust’s founders therefore picked 30 of the strongest American corporations of that fairly grim time (1935) and bought them in equal amounts for their fund. The rule was that the companies could never be sold, except in the case of bankruptcy, mergers or spin-offs.

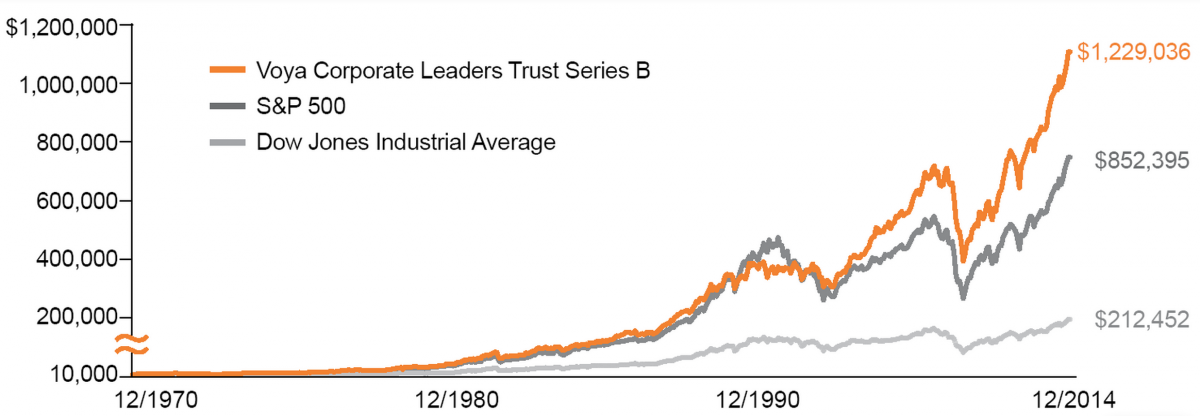

Well here we are and, after 80 years a reappraisal would seem overdue, so how has it done? Lo and behold, the Trust’s founders have been proved right because the Trust is still prospering and without a single new company having been added since. Today the Trust holds 21 companies comprising original members of the portfolio (Union Pacific, General Electric, DuPont, Proctor & Gamble) and some derived from original members (Berkshire Hathaway, CBS, and… Foot Locker would you believe!) So, how has it done? Well here is its performance chart over the last forty years (let’s try to think as long-term as the Trust did):

This is a fascinating poke in the eye for active fund management; simply by buying the best available and then reclining back to “sit on your ass” (Charlie Munger) you could have outperformed the traders, outlasted the fads, left the worrying to the market-addicts, and done very well. Of course, this depended on two things: identifying the strongest companies and then trusting to America to do its thing.

I suspect, for economic historians, the mutations of the various companies that made up the original list of 30 would make an interesting study in itself. It contained four railroad companies, something called the American Radiator & Standard Sanitary (an indescribably dull name) and a lot of Big Oil. Remarkably, amongst of the current line-up of 21, the following still exist largely unaltered from their original corporate form:

- AT&T Inc.

- El Du Pont de Nemours & Co.

- General Electric Co. (of course!)

- Proctor & Gamble Co.

- Union Pacific Corp.

Rather appropriately, for a fund of this nature, the ultimate forever company–Berkshire Hathaway–has found its way into this select little portfolio. It managed this by acquiring the Burlington Northern and Santa Fe Railway company, which had been a product of a merger between the Atchison, Topeka and Santa Fe Railway (an original Trust holding) and Burlington Northern Railway companies.

A little more incongruously, Foot Locker is also to be found lurking in the current portfolio. Foot Locker is the remainder of what was originally F.W. Woolworth and subsequently became Venator Group. I doubt that Foot Locker will exist in another 80 years time but, honestly, who knows?

From the original line-up, two big beasts’ presence will surprise nobody: General Electric (that famous barometer of the American economy) and Proctor & Gamble.

Proctor & Gamble, originally a humble chandler and soap-manufacturer founded by two immigrants (English and Irish), must tick all of the boxes on the check list that defines a perfect company:

- Low-cost, repeat purchase staples

- Branded goods

- Diversified

- Conservatively financed

- Global

- High returns on capital

It is not difficult, albeit with the 20:20 vision of hindsight, to see why holding onto this business led to good results.

General Electric has tested the patience of its investors a little more, at various times, and may even have caused a few sleepless nights during the irritatingly-named Great Recession. Nevertheless, it is getting back to its roots and must look good for another 80 years of churning out dividends to its fortunate owners.

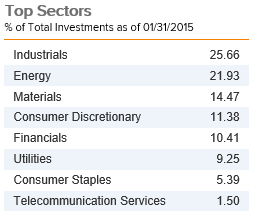

Although I am not surprised that this Trust has done well, I am surprised by the degree to which it has outperformed the S&P because its sector breakdown would seem to contradict that which is usually recommended for outperformance, i.e. it has relatively few asset-light, type companies. It does not contain Coca-Cola, IBM, or General Mills, for example. Here is the breakdown:

60% in Industrials, Energy, and Materials! So much for owning high cash-flow brands with low capital intensity then. It just goes to show that there is more than one way to skin a cat*.

So what do you pay Voya for their hard work in managing this Trust? 52 basis points which, although not high, does seem rather a lot for a fund on which zero analyst work is required. Why could you not reproduce the results of this Trust yourself? Perhaps its investors come to it via other funds, or are put into it without full knowledge of what it is. Regardless, there would have been many worse places to have had your savings over the last century (give or take).

Disclosure: Long BRK.B

Disclaimer: This post is not a recommendation to either buy or sell. Please consult your investment advisor.

* As long as you don’t pay excessive management fees and bet against America.